-

Why CLS Is the Best Choice for Your Medical Malpractice Insurance Needs

CLS Healthcare Liability Specialists is an independent agency that provides healthcare liability insurance in Miami. Our highly knowledgeable team members are pleased to serve hospitals, clinics, locum tenens staffing agencies, and individual physicians, including locum tenens physicians and surgeons. As a med-mal industry leader that provides flexible medical malpractice insurance, CLS is your best choice for liability protection.

CLS Is an Industry Leader

CLS Is an Industry Leader

Among medical malpractice insurance companies in the U.S., CLS has consistently been recognized as an industry leader. Our company is the proud recipient of numerous industry awards, including being named the #1 Writer of Locum Tenens Staffing Companies. For almost three decades, our insurance specialists have been dedicated exclusively to serving the needs of healthcare professionals .We Provide a Diverse Range of Solutions

At CLS, our emphasis is on providing creative solutions for healthcare entities that require healthcare liability insurance. When you partner with our med-mal insurance company, you’ll instantly gain access to all the insurance programs you need. Our specialists will take the time to listen to your liability concerns and learn the details of your practice. Then, we’ll match you to the right insurance policy you need at the price you want.Clients Can Take Advantage of Our Simple Quoting Process

Our medical malpractice insurance specialists understand the time constraints of today’s healthcare professionals. That’s why we’ve made it as easy and quick as possible for you to request your free quote. Simply fill out the quote request form on our website and you’ll hear back from us within 24 hours. Need an answer right away? Our knowledgeable representatives are always available to take your call.Our Dedication to Customer Service is Second to None

Speaking of our knowledgeable representatives, one of the reasons why so many physicians and staffing agencies have come to rely on our services throughout the years is because we offer the best possible customer service. Our friendly insurance specialists provide personalized attention to all prospective and current clients. We’ll answer any questions you may have, guide you through all of your coverage options, and offer recommendations that are best suited to your particular situation. -

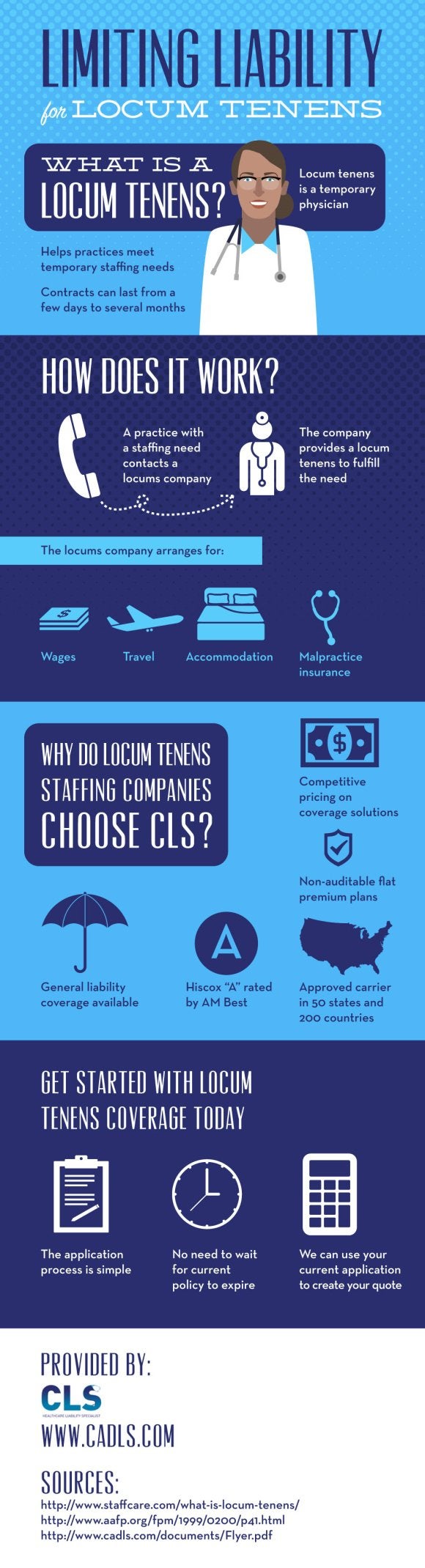

Limiting Liability for Locum Tenens [INFOGRAPHIC]

For physicians, being a locum tenens can open many doors. These temporary positions allow physicians to have flexibility and travel to work in new locations. While there are many upsides to being a locum tenens, having the right professional liability protection is critical. Since traditional medical malpractice insurance doesn’t typically cover locum tenens work, professional liability insurance is usually provided to the temporary physician by the agency that placed him or her in the position. Where do locum tenens companies get their insurance? Find out in this infographic from CLS Healthcare Liability Specialists , a provider of professional liability insurance in Miami. We’re a national leader in meeting the unique insurance needs of medical professionals, from locum tenens insurance to urgent care malpractice insurance. Contact us to discuss your company’s insurance needs and to get a simple quote, and please share this information about our highly rated coverage and affordable premiums with others in the healthcare field.

-

How to Choose Professional Liability Insurance

When choosing professional liability insurance , many healthcare professionals primarily consider their premium payments and the limits of their coverage. Whether or not professional liability insurance in Palm Beach is affordable and comprehensive are certainly important factors in the decision making process. Yet, some healthcare providers may not fully read and understand the other provisions of their policies before signing on the dotted line.

Understanding Defense and Indemnity

A healthcare liability insurance policy will include the responsibilities of the insurance carrier , which involve a duty to defend and indemnify. This means that the insurance carrier is responsible for retaining a lawyer when a med-mal claim is filed. The legal expenses are the responsibility of the carrier. The duty to indemnify means that medical malpractice insurance companies are required to pay any settlement or judgment resulting from that claim, up to a certain limit specified in the policy. Often, an insurance carrier will respect the preferences of the healthcare provider with regard to which particular medical malpractice lawyer is retained. However, this is not necessarily the case all the time. If choosing your own lawyer is important to you, review the assignment of counsel clause in your policy.Choosing Coverage for Proceedings Involving a State Board

Healthcare providers are subject to considerable oversight. In addition to facing aggressive litigation efforts by med-mal lawyers, providers may sometimes become the subject of an investigation by the State Board of Medical Examiners. Not all healthcare liability insurance policies provide coverage for legal representation in these situations. Consider whether it’s in your best interests to choose a professional liability insurance policy that does provide this type of coverage.Evaluating Settlement Provisions

It’s only natural for healthcare providers to interpret med-mal lawsuits as personal affronts; after all, their quality of care is being called into question. As a result, many physicians are reluctant to agree to a settlement deal, particularly considering that both settlements and adverse judgments are reported to the National Practitioner Data Bank. It’s important to review the consent clause of an insurance policy before purchasing it. The consent clause may require that a physician’s consent is necessary before a settlement deal is finalized. Other policies may reserve the right of the carrier to settle over the physician’s objections. -

The Latest Statistics Regarding Nurses and Medical Malpractice Claims

Quite often, nurses are the frontline responders to a patient crisis. Even when a nurse is utterly devoted to upholding the standard of care, he or she can easily be a target of a medical malpractice lawsuit filed by a dissatisfied patient. One quick look at the latest nursing medical malpractice statistics verifies the critical importance of working with a malpractice insurance agency near Palm Beach to obtain comprehensive healthcare liability insurance . For nurses who plan to work for a medical staffing agency, reviewing the locum tenens insurance policy is essential.

Advanced Practice Registered Nurse (APRN)

Advanced practice registered nurses are at the height of their profession, with the master’s or doctoral degree to prove it. Despite their advanced knowledge and highly specialized skillset, APRNs are a frequent target in med-mal lawsuits. According to the National Practitioner Data Bank (NPDB), there were 3,546 APRNs in the U.S. from 2003 to 2013. During the same time period, there were 1,458 adverse actions taken against APRNs, along with 2,791 med-mal payments. The state with the highest number of medical malpractice payments for this category of healthcare professional was Florida, at 382.Licensed Practical Nurse (LPN)

During that same time period, the NPDB reported that there were 49,543 licensed practical nurses (LPNs) in the U.S. and a total of 67,368 adverse actions taken against LPNs. However, 10,579 LPNs were reinstated and the claims only resulted in 399 medical malpractice payments.Registered Nurse

Many individuals who aspired to the healthcare profession chose to become registered nurses (RNs) because of the favorable job outlook, the growth potential, and the lucrative compensation. In fact, from 2003 to 2013, the NPDB reported 70,145 RNs in the U.S. However, during that same time period, a significant number of adverse actions were taken. The NPDB reports 100,709 adverse actions and 3,743 medical malpractice payments. Although the highest number of medical malpractice payments involving RNs was 873 in New Jersey, it’s critical for RNs and other healthcare providers to obtain affordable malpractice insurance wherever they practice. -

Why Choose CLS for Your Locum Tenens Insurance?

If you’re looking for locum tenens insurance in Palm Beach, look no further than CLS Healthcare Liability Specialists. Our company has been given the award of #1 Writer of Locum Tenens Staffing Companies, an honor which our company works hard to uphold by offering exemplary customer service and a diverse range of locum tenens insurance solutions. With three decades of med-mal industry experience and as the largest writer of locum tenens insurance policies in the U.S., you can count on CLS Healthcare Liability Specialists to find the policy you need at an attractive rate.

If you’re looking for locum tenens insurance in Palm Beach, look no further than CLS Healthcare Liability Specialists. Our company has been given the award of #1 Writer of Locum Tenens Staffing Companies, an honor which our company works hard to uphold by offering exemplary customer service and a diverse range of locum tenens insurance solutions. With three decades of med-mal industry experience and as the largest writer of locum tenens insurance policies in the U.S., you can count on CLS Healthcare Liability Specialists to find the policy you need at an attractive rate. Our affordable malpractice insurance for locum tenens staffing companies and individual locum tenens physicians includes blanket additional insurance coverage, defense costs outside available limits, and non-auditable flat premium policies. Since our carrier is approved in every state in the U.S. and in 200 countries, and has six billion in assets, you can rest assured you’re purchasing a policy you can count on. When it’s time to look for locum tenens insurance, we’ll be happy to provide you with a quote at no charge.