-

Limiting Liability for Locum Tenens [INFOGRAPHIC]

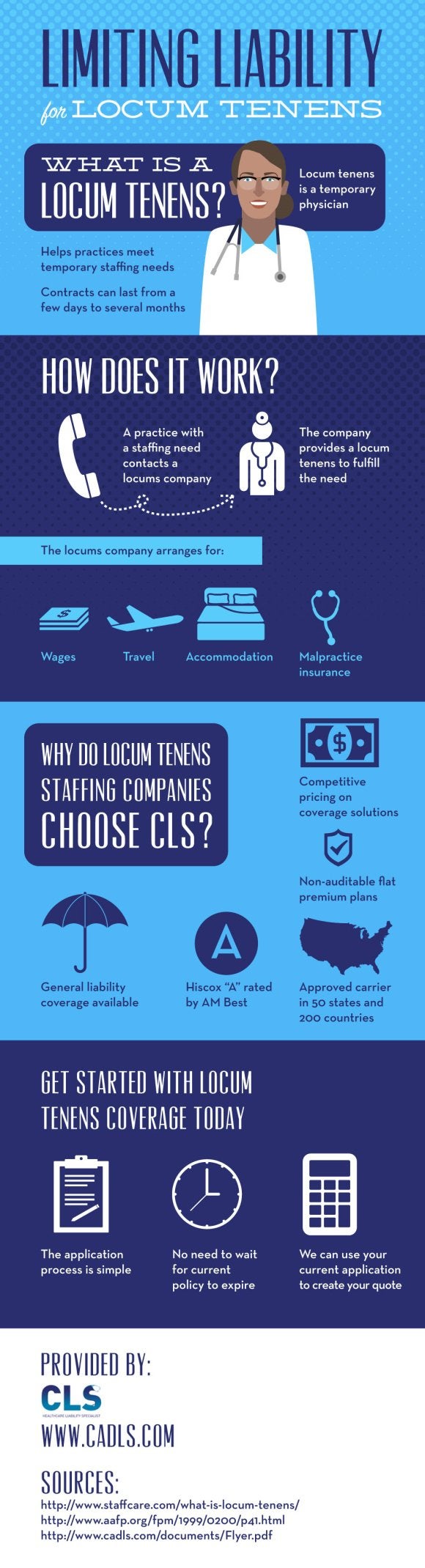

For physicians, being a locum tenens can open many doors. These temporary positions allow physicians to have flexibility and travel to work in new locations. While there are many upsides to being a locum tenens, having the right professional liability protection is critical. Since traditional medical malpractice insurance doesn’t typically cover locum tenens work, professional liability insurance is usually provided to the temporary physician by the agency that placed him or her in the position. Where do locum tenens companies get their insurance? Find out in this infographic from CLS Healthcare Liability Specialists , a provider of professional liability insurance in Miami. We’re a national leader in meeting the unique insurance needs of medical professionals, from locum tenens insurance to urgent care malpractice insurance. Contact us to discuss your company’s insurance needs and to get a simple quote, and please share this information about our highly rated coverage and affordable premiums with others in the healthcare field.

-

How to Choose Professional Liability Insurance

When choosing professional liability insurance , many healthcare professionals primarily consider their premium payments and the limits of their coverage. Whether or not professional liability insurance in Palm Beach is affordable and comprehensive are certainly important factors in the decision making process. Yet, some healthcare providers may not fully read and understand the other provisions of their policies before signing on the dotted line.

Understanding Defense and Indemnity

A healthcare liability insurance policy will include the responsibilities of the insurance carrier , which involve a duty to defend and indemnify. This means that the insurance carrier is responsible for retaining a lawyer when a med-mal claim is filed. The legal expenses are the responsibility of the carrier. The duty to indemnify means that medical malpractice insurance companies are required to pay any settlement or judgment resulting from that claim, up to a certain limit specified in the policy. Often, an insurance carrier will respect the preferences of the healthcare provider with regard to which particular medical malpractice lawyer is retained. However, this is not necessarily the case all the time. If choosing your own lawyer is important to you, review the assignment of counsel clause in your policy.Choosing Coverage for Proceedings Involving a State Board

Healthcare providers are subject to considerable oversight. In addition to facing aggressive litigation efforts by med-mal lawyers, providers may sometimes become the subject of an investigation by the State Board of Medical Examiners. Not all healthcare liability insurance policies provide coverage for legal representation in these situations. Consider whether it’s in your best interests to choose a professional liability insurance policy that does provide this type of coverage.Evaluating Settlement Provisions

It’s only natural for healthcare providers to interpret med-mal lawsuits as personal affronts; after all, their quality of care is being called into question. As a result, many physicians are reluctant to agree to a settlement deal, particularly considering that both settlements and adverse judgments are reported to the National Practitioner Data Bank. It’s important to review the consent clause of an insurance policy before purchasing it. The consent clause may require that a physician’s consent is necessary before a settlement deal is finalized. Other policies may reserve the right of the carrier to settle over the physician’s objections. -

The Latest Statistics Regarding Nurses and Medical Malpractice Claims

Quite often, nurses are the frontline responders to a patient crisis. Even when a nurse is utterly devoted to upholding the standard of care, he or she can easily be a target of a medical malpractice lawsuit filed by a dissatisfied patient. One quick look at the latest nursing medical malpractice statistics verifies the critical importance of working with a malpractice insurance agency near Palm Beach to obtain comprehensive healthcare liability insurance . For nurses who plan to work for a medical staffing agency, reviewing the locum tenens insurance policy is essential.

Advanced Practice Registered Nurse (APRN)

Advanced practice registered nurses are at the height of their profession, with the master’s or doctoral degree to prove it. Despite their advanced knowledge and highly specialized skillset, APRNs are a frequent target in med-mal lawsuits. According to the National Practitioner Data Bank (NPDB), there were 3,546 APRNs in the U.S. from 2003 to 2013. During the same time period, there were 1,458 adverse actions taken against APRNs, along with 2,791 med-mal payments. The state with the highest number of medical malpractice payments for this category of healthcare professional was Florida, at 382.Licensed Practical Nurse (LPN)

During that same time period, the NPDB reported that there were 49,543 licensed practical nurses (LPNs) in the U.S. and a total of 67,368 adverse actions taken against LPNs. However, 10,579 LPNs were reinstated and the claims only resulted in 399 medical malpractice payments.Registered Nurse

Many individuals who aspired to the healthcare profession chose to become registered nurses (RNs) because of the favorable job outlook, the growth potential, and the lucrative compensation. In fact, from 2003 to 2013, the NPDB reported 70,145 RNs in the U.S. However, during that same time period, a significant number of adverse actions were taken. The NPDB reports 100,709 adverse actions and 3,743 medical malpractice payments. Although the highest number of medical malpractice payments involving RNs was 873 in New Jersey, it’s critical for RNs and other healthcare providers to obtain affordable malpractice insurance wherever they practice. -

Why Choose CLS for Your Locum Tenens Insurance?

If you’re looking for locum tenens insurance in Palm Beach, look no further than CLS Healthcare Liability Specialists. Our company has been given the award of #1 Writer of Locum Tenens Staffing Companies, an honor which our company works hard to uphold by offering exemplary customer service and a diverse range of locum tenens insurance solutions. With three decades of med-mal industry experience and as the largest writer of locum tenens insurance policies in the U.S., you can count on CLS Healthcare Liability Specialists to find the policy you need at an attractive rate.

If you’re looking for locum tenens insurance in Palm Beach, look no further than CLS Healthcare Liability Specialists. Our company has been given the award of #1 Writer of Locum Tenens Staffing Companies, an honor which our company works hard to uphold by offering exemplary customer service and a diverse range of locum tenens insurance solutions. With three decades of med-mal industry experience and as the largest writer of locum tenens insurance policies in the U.S., you can count on CLS Healthcare Liability Specialists to find the policy you need at an attractive rate. Our affordable malpractice insurance for locum tenens staffing companies and individual locum tenens physicians includes blanket additional insurance coverage, defense costs outside available limits, and non-auditable flat premium policies. Since our carrier is approved in every state in the U.S. and in 200 countries, and has six billion in assets, you can rest assured you’re purchasing a policy you can count on. When it’s time to look for locum tenens insurance, we’ll be happy to provide you with a quote at no charge.

-

The Costs of Medical Malpractice Lawsuits

Many healthcare providers dread the day they might receive a notice of misrepresentation from a disgruntled patient’s attorney. It’s essential to have healthcare liability insurance in Palm Beach. However, while affordable malpractice insurance such as medical staffing insurance protects you from liability in the event of a lawsuit , the overall costs of medical malpractice to the U.S. economy are staggering.

When you watch this video from CNN, you’ll hear two experts debating the merits of medical malpractice caps and discussing the pitfalls of defensive medicine. While medical malpractice payouts equal approximately $1.4 billion each year, defensive medicine has been shown to cost the U.S. economy far more in unnecessary medical expenditures. This video serves as a good reminder of the importance of regularly reviewing your healthcare liability insurance policy to ensure adequate coverage.

-

Professional Liability Insurance Explained

If you’re entering a new practice, you may be offered professional liability insurance as part of your benefits package. However, it’s well worth your time to scrutinize exactly what that policy covers. In the majority of cases, healthcare liability insurance offered as an employment benefit is claims-made coverage, which only protects you in the event that the same insurance company covered you at the time of the alleged incident and at the time the lawsuit was filed. If you are interested in more comprehensive healthcare liability insurance in Palm Beach, you may wish to take out an occurrence-made insurance policy.

Hear more about the different types of affordable malpractice insurance by watching this video. This certified financial planner explains the benefits of obtaining claims-made and occurrence-made insurance policies, and discusses the situations in which “tail” insurance can be helpful.

-

Understanding Locum Tenens Insurance

Often, physicians are responsible for purchasing their own healthcare liability insurance, which is one reason why so many have considered applying for locum tenens positions. With a locum tenens position, the placement company is almost always responsible for providing locum tenens insurance in Palm Beach. In some cases, the healthcare facility that is engaging the locum tenens provides the coverage. If you’re considering applying to a locum tenens company, it’s imperative to read the fine print before you sign any agreement. Not only will you need to make sure that you understand the terms of your engagement, your cancellation clause, and other provisions, but you must also make sure that the placement agency provides exceptional locum tenens insurance .

Understanding Claims-Made Coverage

Locum tenens placement companies often offer claims-made hospital malpractice insurance. These policies provide coverage for physicians in the event that an incident both occurred and was reported within the active period. This means that if the policy extends to February 1, 2015 and an incident was not reported until February 2, 2015, coverage is not provided. Generally, claims-made coverage is somewhat riskier for locum tenens physicians, given the short-term duration of the engagement and given that the placement agency, not the physician, is in control of the policy renewal.Evaluating Occurrence-Made Coverage

Many locum tenens physicians prefer to apply to placement agencies that offer occurrence-made coverage, which provides more comprehensive protection. With this type of locum tenens insurance, the physician is covered for all alleged incidents that occurred within the active period of the policy, regardless of when the claim is filed. This means that even if the healthcare liability insurance coverage expires on June 1, 2015, and an incident that occurred months earlier is not reported until June 1, 2016, the policy still provides coverage.Purchasing “Tail” Insurance

Even when a locum tenens placement agency provides claims-made coverage, physicians can obtain additional protection if the contract includes a provision for the purchase of “tail” insurance. Purchasing “tail” insurance with a coverage period of at least two years is preferable, given that the typical medical malpractice statute of limitations is two years. -

A Look at Our Locum Tenens Insurance Coverage

For many physicians, locum tenens positions offer the ability to travel to new locations, transition to the next stage in their careers, and choose their own assignments. And for existing practices, locum tenens employees provide an ideal stop-gap solution to temporary staffing shortages. CLS Healthcare Liability Specialists is the leading provider of locum tenens insurance in Palm Beach. We also provide affordable malpractice insurance from our offices in Georgia and Texas.

For many physicians, locum tenens positions offer the ability to travel to new locations, transition to the next stage in their careers, and choose their own assignments. And for existing practices, locum tenens employees provide an ideal stop-gap solution to temporary staffing shortages. CLS Healthcare Liability Specialists is the leading provider of locum tenens insurance in Palm Beach. We also provide affordable malpractice insurance from our offices in Georgia and Texas.When you choose our company for your medical staffing insurance needs, you’ll have access to highly competitive premiums—a must in today’s evolving healthcare industry. We offer non-auditable flat premium policies, with defense cost outside the limits available. Our top-rated carrier has been approved not only in all 50 states, but in 200 countries. If it’s time to upgrade your locum tenens insurance, you can rely on CLS Healthcare Liability Specialists to provide premium coverage and a simplified quoting process. Plus, when you work with our experts, you won’t have to purchase “tail” insurance from your current provider.

-

Answers to FAQs About Medical Malpractice Insurance

Tens of thousands of medical malpractice claims are filed each year in the U.S. While no physician likes to think that he or she will be named as a defendant at some point, in today’s litigious society, it’s entirely possible. Comprehensive healthcare liability insurance is an absolute must for all practitioners. When evaluating medical malpractice insurance companies near Palm Beach, the following questions may arise.

Why Should Physicians Purchase Their Own Liability Coverage?

In some cases, having healthcare liability insurance through the hospital or facility is sufficient. However, you may wish to purchase additional coverage for yourself, depending on a number of factors. First, given the likelihood of a claim occurring at some point during your career, it only makes sense to protect yourself with affordable malpractice insurance that goes above and beyond what your hospital offers. Second, you may want to change employers at some point or your current facility may close, in which case having your own policy offers portability. And third, the coverage your hospital offers may provide inadequate coverage.How Should I Choose an Insurance Company?

It’s a good idea to choose an independent agency that specializes in medical malpractice insurance. Select an agency that is well established in the field, such as one that has been in business for at least a couple of decades. Your agency should work with financially stable carriers with top ratings.What Will My Policy Cover?

The answer to this question varies depending on your particular policy. There are different types of coverage options, such as claims-made and “tail” coverage. It’s always a good idea to read a policy before purchasing it or to have an attorney help you understand it. Generally, healthcare liability insurance will cover settlements, damages, and court costs.What Information May be Reported?

In the event that a claim is filed against you and your healthcare liability insurance company makes a payment to the plaintiff, the insurance company is required to report the payment to the National Practitioner Data Bank.What are Policy Limits?

You’ll notice that your insurance policy has an individual limit and an aggregate limit. The individual limit is the maximum amount that will be paid for any particular claim. The aggregate limit is the maximum payout for all of the claims within the term of the policy. -

Medical Malpractice Insurance and -Terminating the Physician Patient Relationship

“I need to talk to YOU”, barked the elderly mother of my friend, Jane.

“ My Cardiologist FIRED ME! ” she exclaimed.

“ For being a non-compliant patient?” I queried.

“ How did YOU KNOW ? “ She demanded. My friend Jane gave me a knowing look. Hmm I thought, need to be diplomatic here. “ Well, that is the primary reason a doctor will terminate the patient/doctor relationship.” I tried to sound matter of fact.

“HMPH! She snorted…just because I don’t want to take all that diabetes and cholesterol medication he prescribed for me—I just don’t believe in it! It’s a conspiracy between the pharmaceutical companies and the doctors! Firing a patient–I never HEARD of such a thing!”

I sure have, I thought!

Nothing says high-risk, non-compliant patient like a cantankerous older, obese patient with several chronic conditions, who refuses to follow their prescribed medication regimen.

Many physicians find it difficult to terminate a long-term relationship with a patient. A physician has every right, in fact it is good loss prevention policy, to terminate your relationship with a non-compliant patient after you have exhausted every effort to manage their condition.

Kimberly Hathaway, MSN, RN, LHRM, CPHRM, CPHQ

Risk Manager for The Doctors Company, advises ” It is good practice to discuss issues related to keeping appointments, acceptable behavior or compliance with the prescribed treatment with the patient, prior to sending the patient a discharge letter. In very few instances should the letter be the first indication to the patient that things just aren’t working between you. Each situation is different, but a physician has the right, in fact it is good loss prevention policy, to terminate the relationship with a non-compliant or disruptive patient after you have exhausted other efforts to manage their behavior and or condition”.

Most brand name malpractice insurance companies have a Risk Management or Patient Safety consultant that can provide you with guidelines, resources and medic-legal advice, if you have a patient relationship that you feel you need to terminate. Take advantage of this resource so that you can protect yourself.